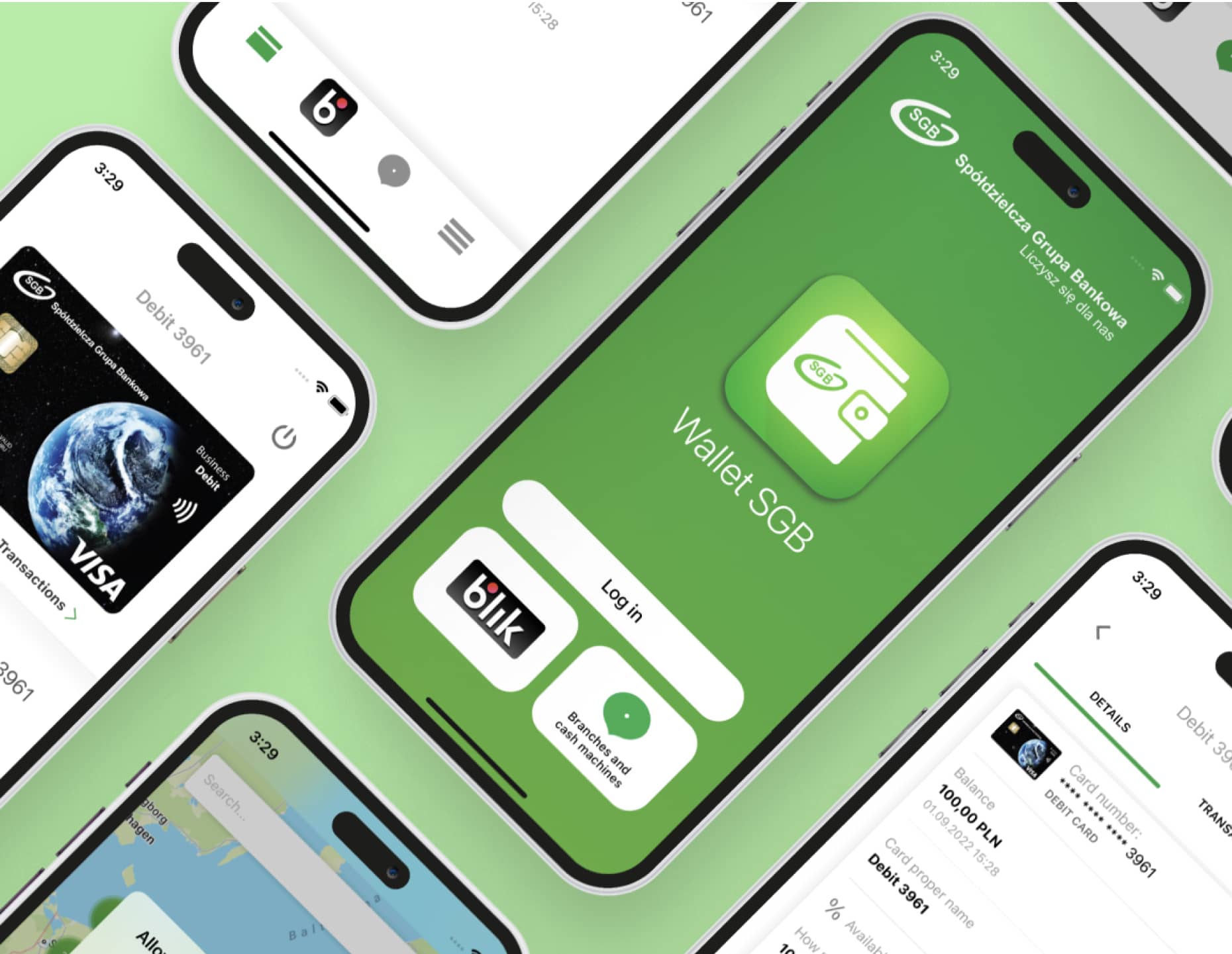

SGB Wallet

In a Nutshell

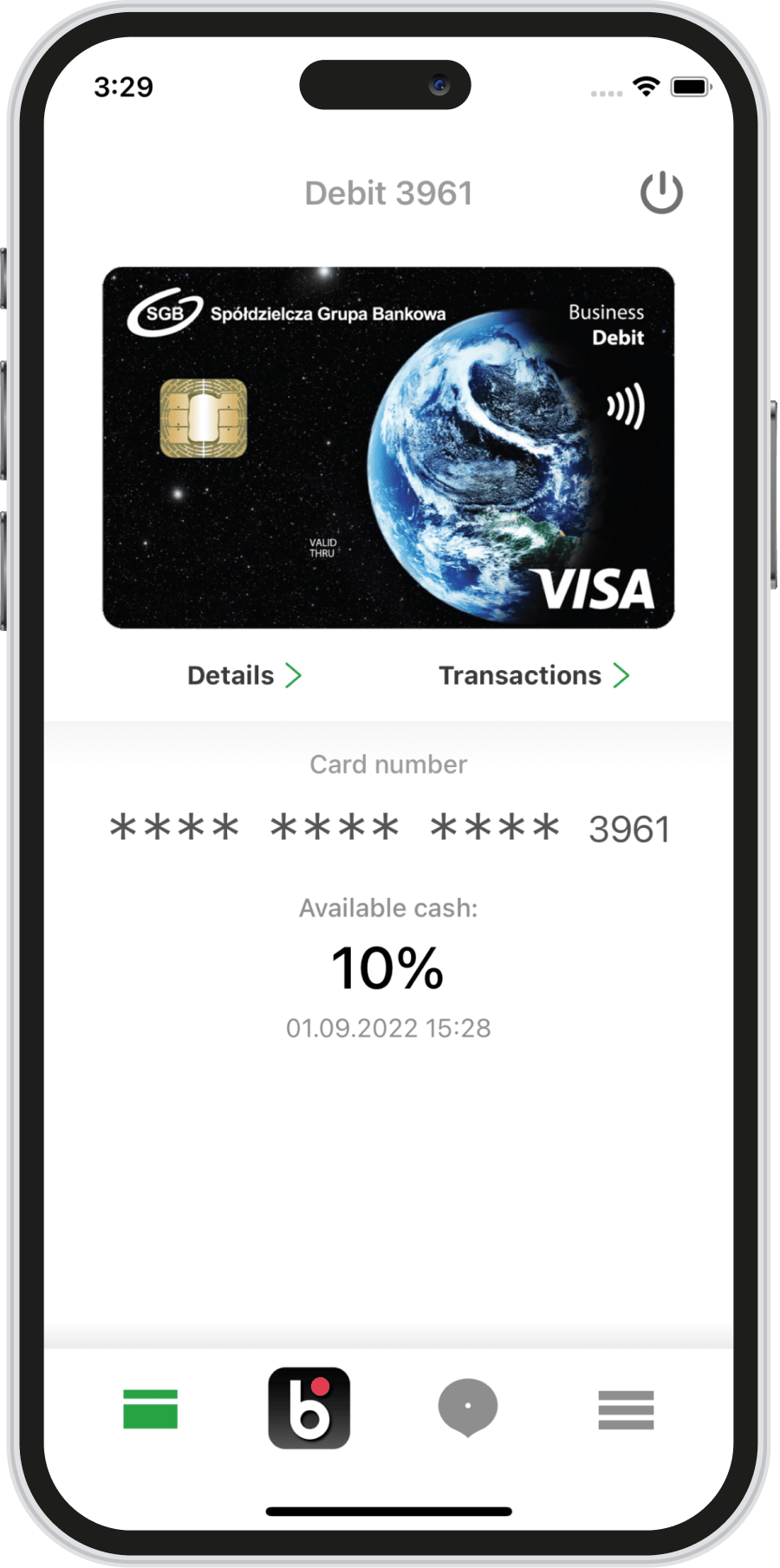

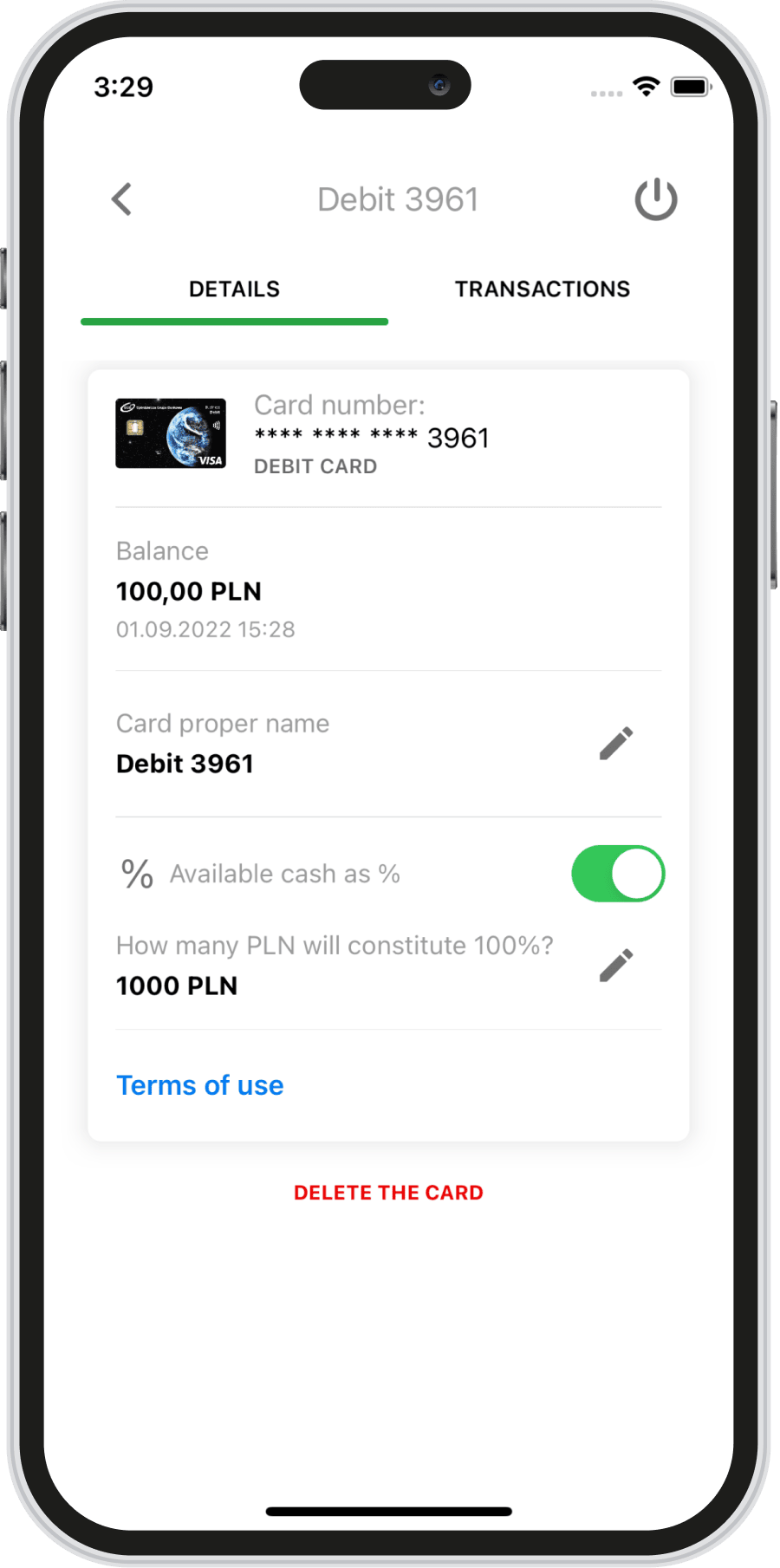

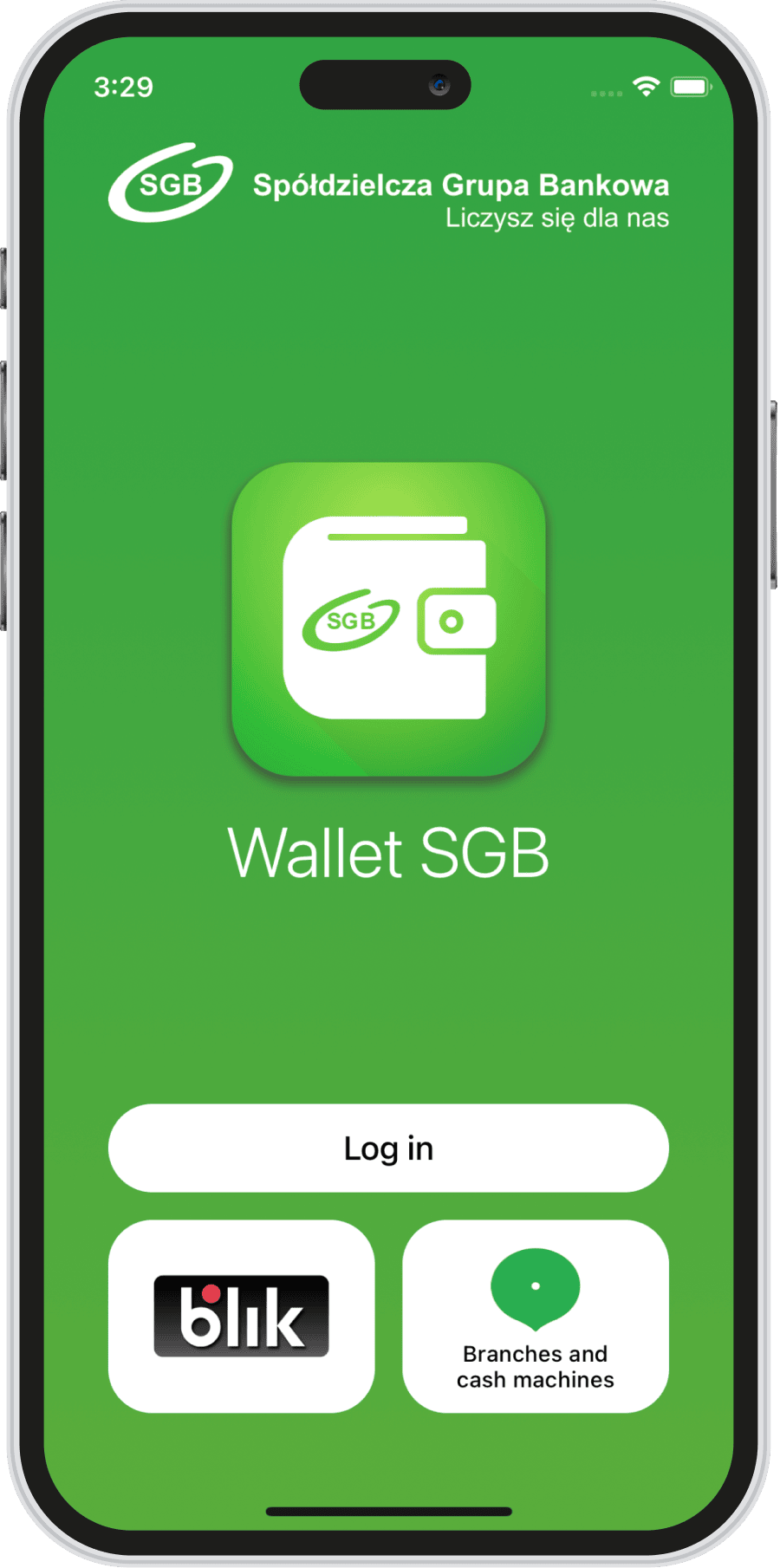

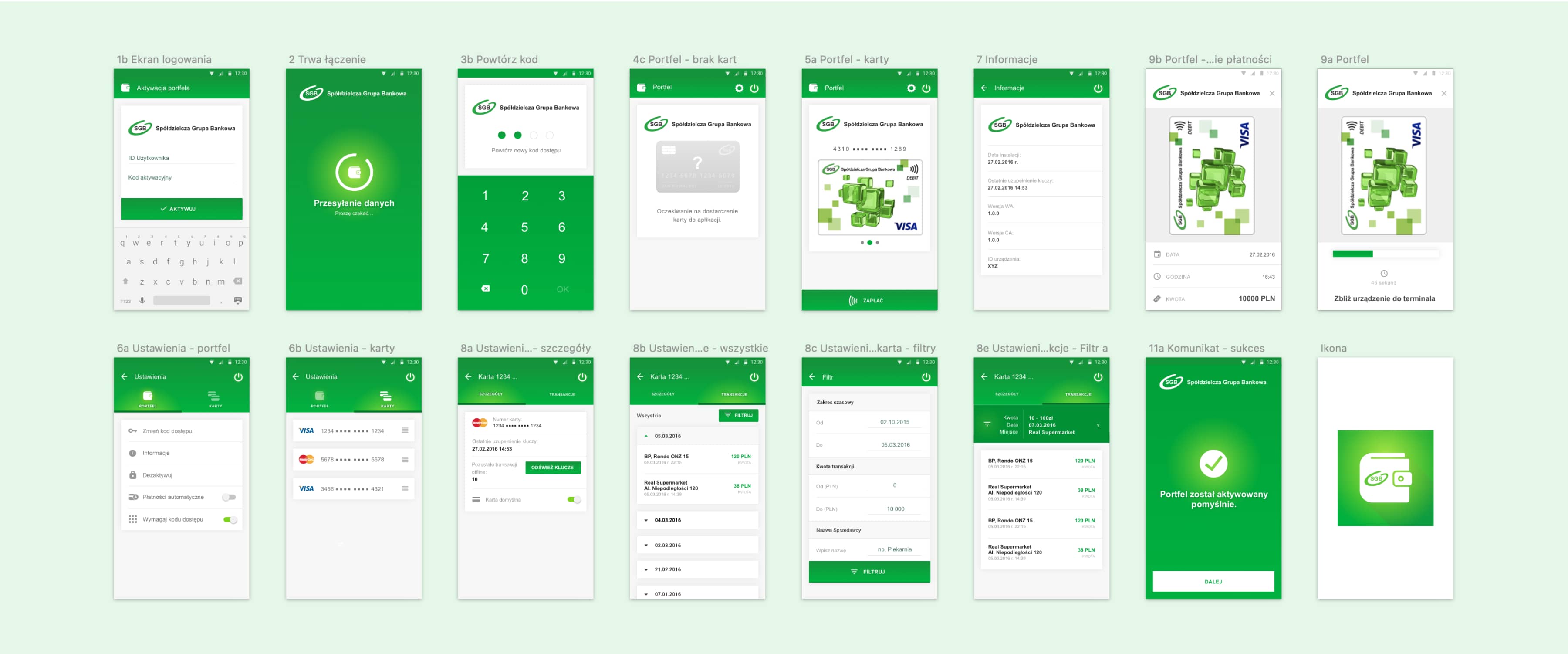

1.

banking app in Poland for cooperative banks

176

banks in one app

2 cards

integrated with the HCE library in the app: Mastercard and VISA

Industry

Banking

Project Scope

- Graphic design

- Development

- Quality Assurance

- Maintenance

Client

Challenge

Solution

Interesting Fact

Challenge

Challenge

- code darkening – to hinder reverse engineering

- verification of the environment in which the application operates – to try to block it from running on a computer and allow it only on a mobile device

- verification of the code integrity of the application – to detect changes made by third parties

- symmetric and asymmetric encryption to maintain the confidentiality of processed information

- identity verification of the server to which the application connects – to protect the user from eavesdropping on the information transmitted by third parties

Portfel SGB x Norbsoft

0

Keep scrolling 👌